Product Introduction

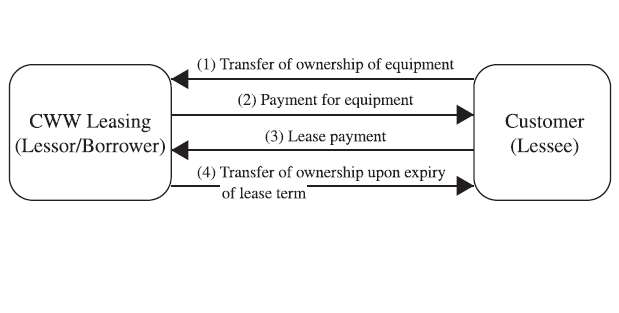

In a sale-leaseback, our customer, as the lessee, sells the existing assets to us, and then we, as the lessor, lease the assets back to our customer for its use. During the lease term, our customer remains in possession of the underlying assets, and repays the purchase amount of the assets, interests and other fees to us. At the end of the lease term, the ownership of the assets will be.

operation workflow:

Product Introduction

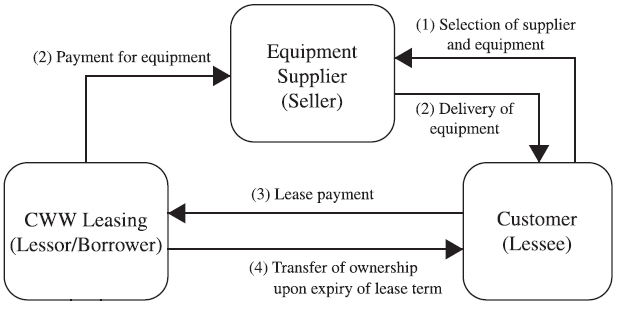

Direct financial leasing is a type of financial leasing service where we, as the lessor, purchase the assets under the lease agreement from the seller (i.e. equipment manufacturer) for our customer, who is the lessee. We then lease the assets to our customer for its use. We also cooperate with equipment manufacturers to provide direct financial leasing for our customer.

In a direct financial leasing, we, as the lessor, purchase the assets from the seller for our customer, who is the lessee. We then lease the assets to our customer for its use in accordance with the terms and conditions of the financial leasing agreement. During the lease term, our customer remains in possession of the leased assets and repays the purchase amount of the assets, interest and other fees to us. At the expiry of the lease term, the ownership of the assets will be transferred to our customer at a nominal consideration.

operation workflow:

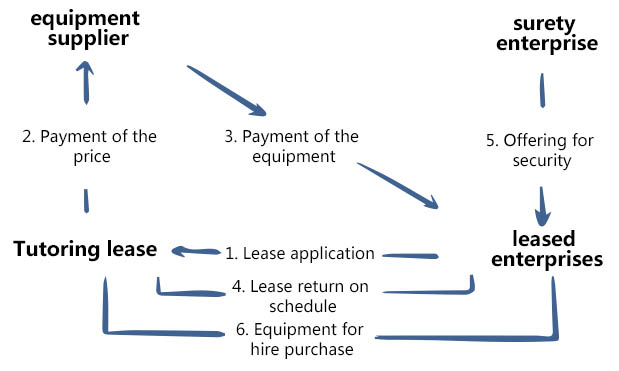

Product Introduction

The typical finance lease mainly solves such problems as slow recycling of fund during the large-scale equipment manufacturer is selling products, difficult financing for enterprises or insufficient liquid capital caused by one-time investment. The subjects involved include the leased enterprises, equipment manufacturers and financial leasing companies. By working with large equipment manufacturer and through its sales channels, the leasing company solves the problem of funds to purchase equipment for its customer: on the one hand, it can help the equipment manufacturer to achieve one-time sale, and modes of payment can be negotiated more flexibly in the sales process; on the other hand, it can reduce the purchasing enterprise’s one-time payment pressure, promoting upgrade of its equipment.

Product Advantages

1. Meet the needs of the leased enterprise for its equipment finance during startup.

2. Flexibly arrange the rent amount, return date and return ways for the leased enterprise.

3. The cost of equipment is paid in full to reduce the one-time payment pressure on the leased enterprise.

4. Effectively solve the difficulty in financing of small-and-medium-sized enterprises in the process of upgrading and transforming their equipments.

5. Promote the equipment sales of equipment manufacturers, and help them achieve that year's sales tasks more smoothly.

The program applies to customers.

Various enterprises with equipment modification requirements and with good prospects for development but temporary shortfall of cash

operation workflow:

Product Introduction

Leveraged lease is a type of finance lease, which refers to a kind of financing structure, namely, under the requirements and arrangements of the project investors, CWW Leasing finances to purchase the assets of the project and then leases the assets to the enterprise accepting lease.

Product Advantages

Income and credit guarantee of CWW Leasing and financing loan bank mainly come from the tax benefits of the structure, lease expense, assets of the project and control of the cash flow of the project. Project financing model based on the leveraged lease is the model innovation of project financing, with significant taxation advantages. Through the leverage effect of “two wins eight”, absorb the project’s assets depreciation and interest deductions, fully enjoying the tax benefits, achieving win-win situation among CWW Leasing, the leased company and the borrower.

The program applies to customers.

The mode configuration has ingenious design and complex financing arrangement, suitable for large scale and oversize projects.

Product Introduction

The leasing company buys equipment from a domestic equipment manufacturer and leases it to a foreign leased enterprise or exporter in the form of a financing lease or an operating lease.

Support the national manufacturing industry to go out and explore overseas markets.

Ownership, risk taking, accounting record and others depend on the form of lease.

Product Advantages

1. It is easier and safer for exporters to collect bill.

2. The exporter owns ownership of the equipment under the financing lease.

3. The leasing company has legal ownership, so assets are safer.

4. Safety mechanism controls equipment by leasing company, reducing the risk.

5. Enjoy better export tax rebate policy.

The program applies to customers.

Large equipment export

Overseas large-scale projects undertaken by domestic enterprises